michigan gas tax rate

52 rows The current federal motor fuel tax rates are. It will remain in place until at least the end of the year.

Michigan Sales Tax Small Business Guide Truic

The average state gas tax is about 30 cents a gallon though they range from less than 10 cents to nearly 60 cents a gallon.

. Prepaid GasolineDiesel Fuel Rates - April 2022. Information on natural gas service and rates for residential customers in Michigan. How a rate review works.

For general questions please email. The tax on regular. The totals include state and federal taxes.

When the various charges are added together Michigan drivers already pay the nations 10th. For fuel purchased January 1 2017 and through December 31 2021. 263 cents per Michigan motor fuel tax.

202 cents per gallon. For fuel purchased January 1 2022 and after. Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST.

Exact tax amount may vary for different items. Canada Fuel Tax Rates. Effective April 1 2022 the State of Michigan has updated the prepaid gasoline and diesel fuel rates as follows.

The user-pays principle the idea that the people who use transportation infrastructure should fund it through paying taxes justifies such a scheme. Michigan drivers pay 42 cents per gallon in state gas taxes. Not enough gas tax revenues are being raised to.

These tax rates are based on. Michigan tax forms are sourced from the Michigan income tax forms page and are updated on a yearly. Diesel Fuel 272 per gallon.

Some fees and taxes like sales tax vary by. Michigan fuel purchases are also subject to the 6 state sales tax. Motor Fuel Tax The state of Michigan imposes a 19-cent per gallon excise tax on gasoline used in motor vehicles.

At that rate Michigan motorists would pay 76 million more in the state gas tax each year starting in 2022. The Michigan state sales tax rate is 6 and the average MI sales tax after local surtaxes is 6. 2022 Michigan state sales tax.

What is Michigans gas tax now. Diesel Fuel 263 per gallon. Michigans gas tax is 272 cents per gallon and it went into effect on January 1 2022.

US Fuel Tax Rates. Washington had the highest state gasoline tax rate of 310 cents per gallon. Natural gas prices as filed with the Michigan Public Service Commission.

The Center Square State gas. Call center services are available from 800am to 445PM Monday Friday. MI Sales Tax Express Program.

For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is. Michigan Gas Choice allows you to choose your natural gas supplier from participating suppliers. 26 rows Gasoline and Diesel Tax rates also include a 8-875 cpg state sales tax 4 local sale.

Michigan natural gas rates. What is in a Barrel of Crude. COVID-19 Updates for Michigan Motor Fuel Tax Motor Fuel Tax Return filing deadlines have not changed.

120 cents per Michigan sales tax 6 of 200 TOTAL 567 cents. Comparing gasoline tax rates among states is compli cated because states levy other additional taxes. Prepaid Gasoline Diesel Fuel Rate Change.

In 2005 Michigans gasoline tax rate was one of the lowest ranking 31 st nationally see Exhibit 13 and Exhibit 31 in the Appendix. Gasoline 263 per gallon. Per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon.

The same three taxes are included in the retail price on. Compressed Natural Gas CNG 0184 per gallon. 1 2017 as a result of the 2015 legislation.

176 cents per gallon. Crude Oil Price Chart. This tax is established in the Motor Fuel Tax Act 2000 PA 403.

MiMATS users should continue to use the MiMATS eServices portal. Prepaid Diesel Fuel Rate. To enter the rates - go into the.

If a gallon of gas at the pump sells for 256 cents then 22 of the price is composed of federal and state taxes. Groceries and prescription drugs are exempt from the Michigan sales tax. Michigan fuel taxes last increased on Jan.

Gas Price Heat Map. Alternative Fuel which includes LPG 263 per gallon. Michigans total gas tax the 27-cent excise tax and the 6 sales tax was the 11th highest in the nation in 2021 behind states such as.

US Fuel Tax State Map. Motorists here already pay the 184 cent per gallon federal gas tax. Counties and cities are not allowed to collect local sales taxes.

Gasoline 263 per gallon. Gasoline 272 per gallon. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

Michigan had the sixth-highest gas tax in the nation in January 2022 at 0641 per gallon. Didnt gas taxes just go up. An analysis in June by the nonpartisan Tax Foundation found Michigans state gas taxes and fees were the 10th-highest in the nation at 4512 cents per gallon.

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

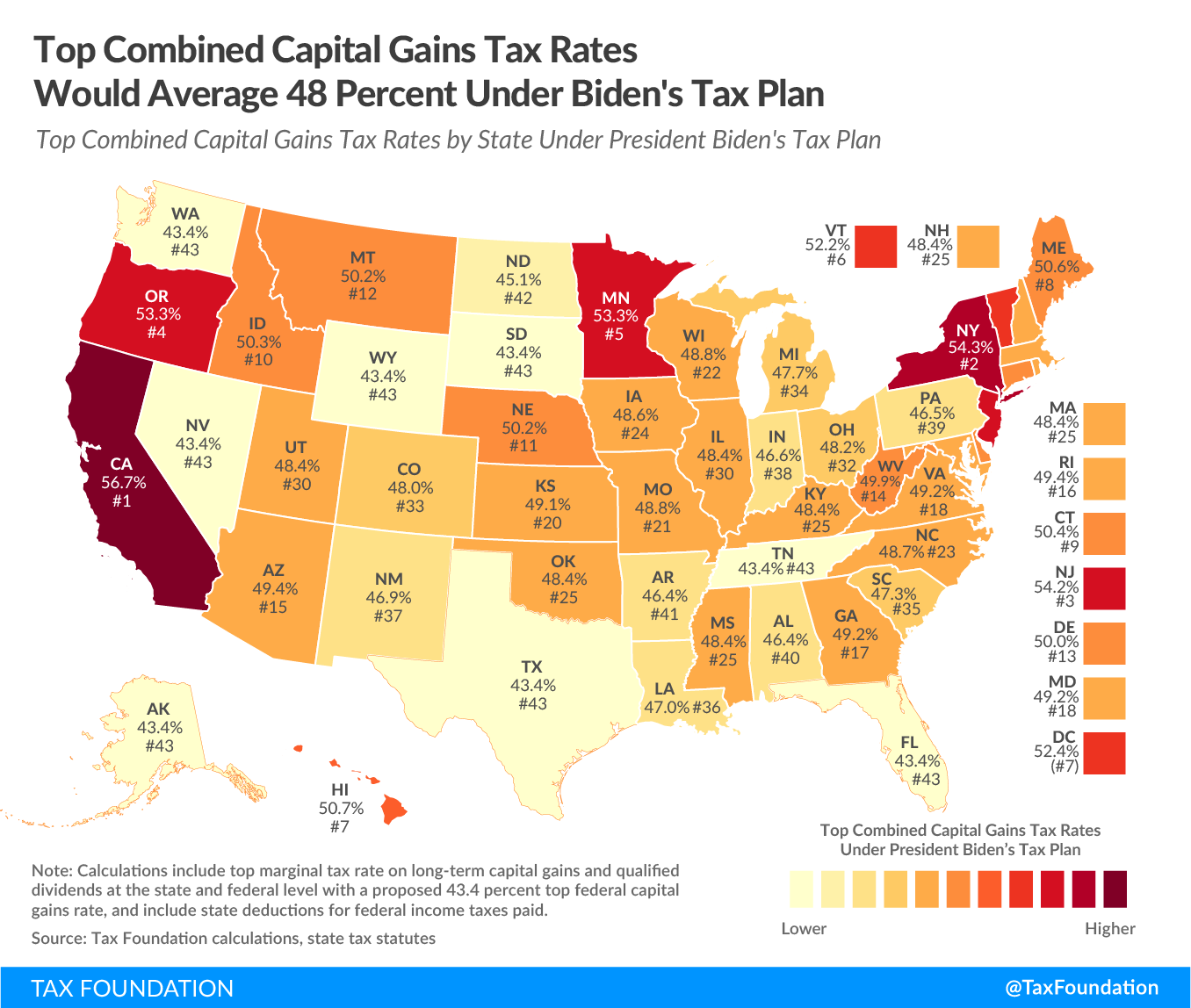

Combined Capital Gains Tax Rate In Michigan To Hit 47 7 Under Biden Plan Michigan Farm News

Michigan Gas Tax Calculator Michigan Petroleum Association

A New Map Courtesy Tax Foundation Shows Where Pennsylvania Stacks Up On State Gas Taxes For More Infographic Map Safest Places To Travel Best Places To Retire

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

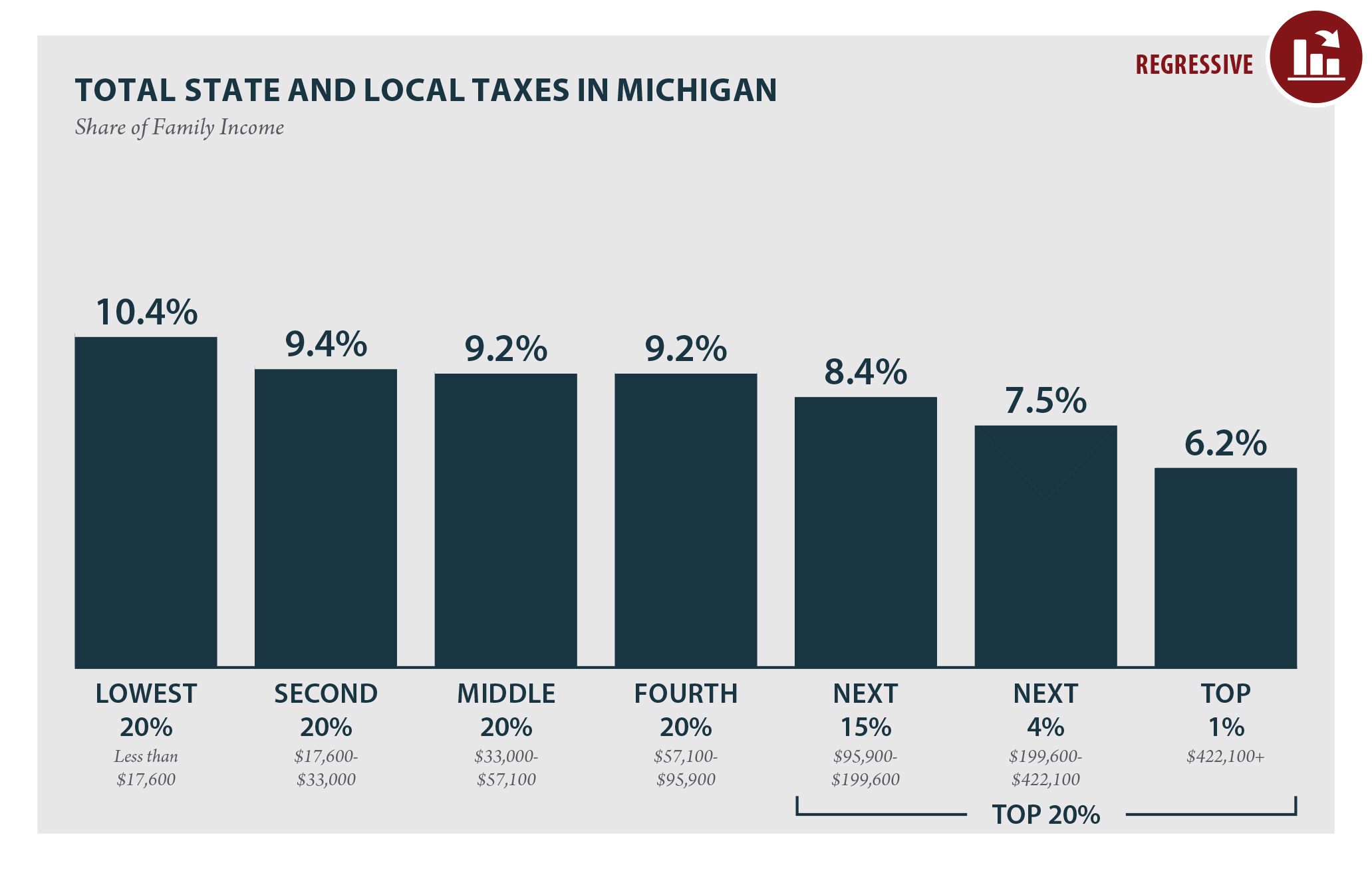

Michigan Who Pays 6th Edition Itep

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Factoring Accounts Receivables

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

10 Fortune 500 Corporations That Pay Lower Tax Rates Than You Tax Rate Low Taxes Federal Income Tax

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

What Does An Additional Penny Of Gas Tax Buy Bridge Michigan

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

Pin Di Pt Equityworld Futures Semarang

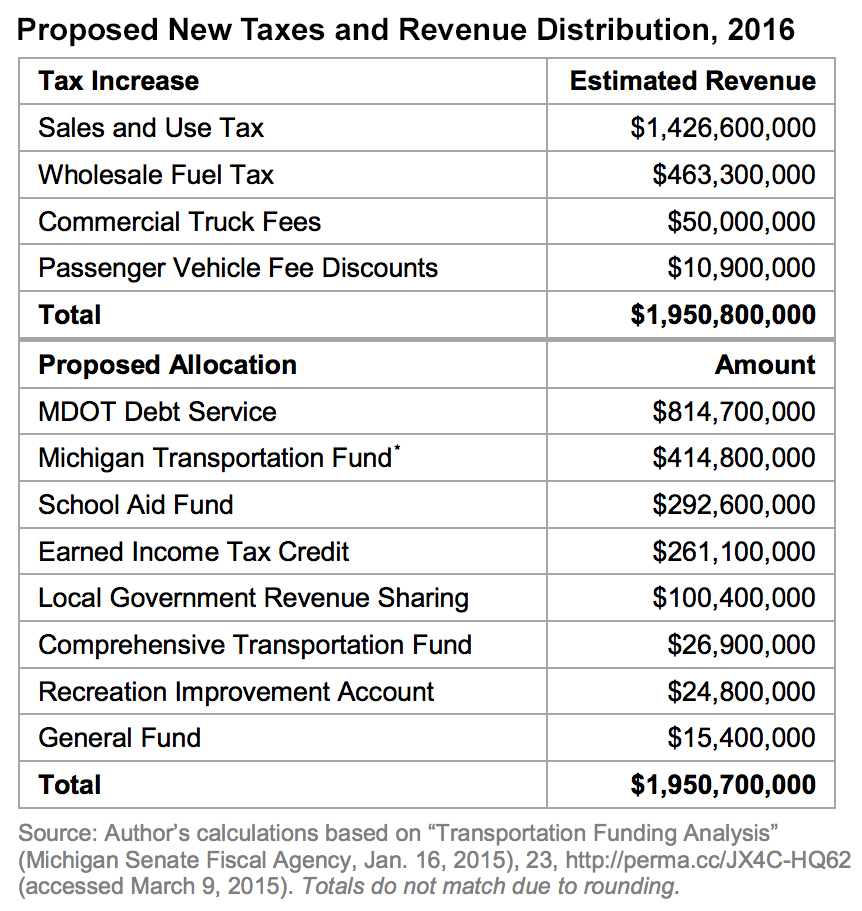

Michigan S May Tax Proposal Mackinac Center

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump